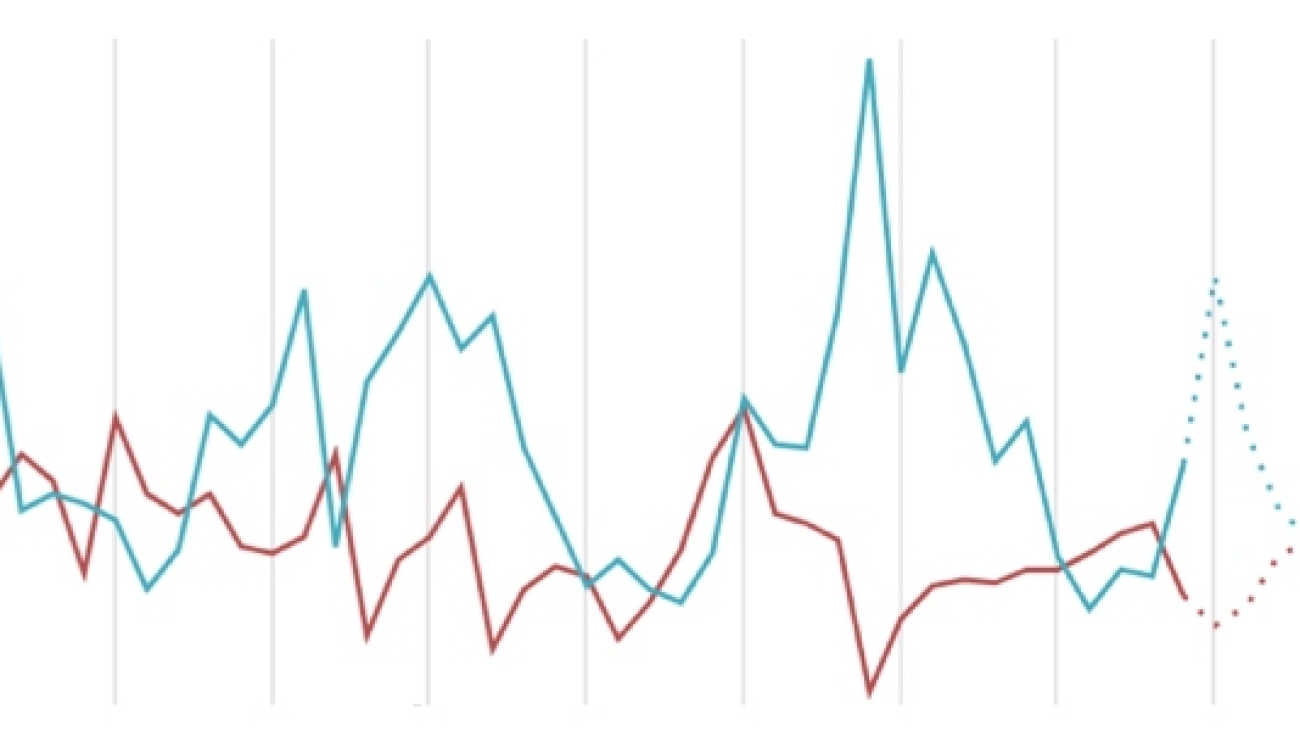

The economic watch is highly anticipated next week as all interest is on how the elections will unfold. We will take the opportunity to discuss Pakistan’s weak growth as one of the challenges affecting the economy after inflation.

We will also explore why reforms are required and identify global factors that could potentially harm Pakistan the most.

Table 1: GDP Growth Rate (World Bank)

| Fiscal Year (FY) | GDP Growth (%) |

|---|---|

| FY23 (Estimated) | -0.6 |

| FY24 (Projected) | 1.7 |

| FY25 (Projected) | 2.3 |

Table 2: Economic Outlook and Challenges Report

| Outlook and Risks | Sectoral Recovery Expectations |

|---|---|

| Sluggish economic growth expected | Expected recovery in the agriculture sector |

| High downside risks | Marginal easing of import restrictions |

| IMF Stand-By Arrangement approval | Some recovery in the industrial sector |

| Reserves expected to remain low | Strengthening agriculture and industry supports services |

Table 3: Export Projections (IMF)

| Fiscal Year (FY) | Export Proceeds (in billion USD) |

|---|---|

| FY24 | $30.84 |

| FY25 | $32.35 |

| FY26 | $34.68 |

| FY27 | $37.25 |

| FY28 | $39.46 |

Table 4: Remittances, World Bank Forecast for 2024

| Year | Forecasted Growth (%) | Estimated Remittance Amount (in billion USD) |

|---|---|---|

| 2024 | -10 | Below $22 billion |

Table 5: Global Factors Impacting Remittances in 2023

| Factor | Impact on Growth |

|---|---|

| Shift in trend: Families moving out of PK | Decline |

| Weak growth in other GCC & EU countries | Decline |

| Oil prices and production drop | Decline |

Summary Table: Risks Without Reforms

| Risks Without Reforms |

|---|

| – Exceptionally high risks |

| – Economic activity constrained. Anaemic GDP Growth |

| – Low investment & weak exports undermine growth potential |

| – Over 10 million people at risk of falling into poverty without reforms |

Global Factors Table

| Factor/Event | Impact/Concern |

|---|---|

| Federal Reserve Action | Fed crushes March rate-cut hopes. Will freeze liquidity. Stock markets remain south bound |

| China’s Property Meltdown | Reinforces belief in a global deflation shockwave stemming from China’s property market meltdown |

| Brent Forecast | Forecast range: $70 to $80; Breach above may not be good for the global economy & especially Pakistan |

| Geopolitical Uncertainty | More aggressive posture by warring countries may escalate uncertainty and commodity prices |

(The writer is a Former Chairman and Managing Director PIA, Former Federal Minister of industries and production)

Pakistan Growth Story in Tables