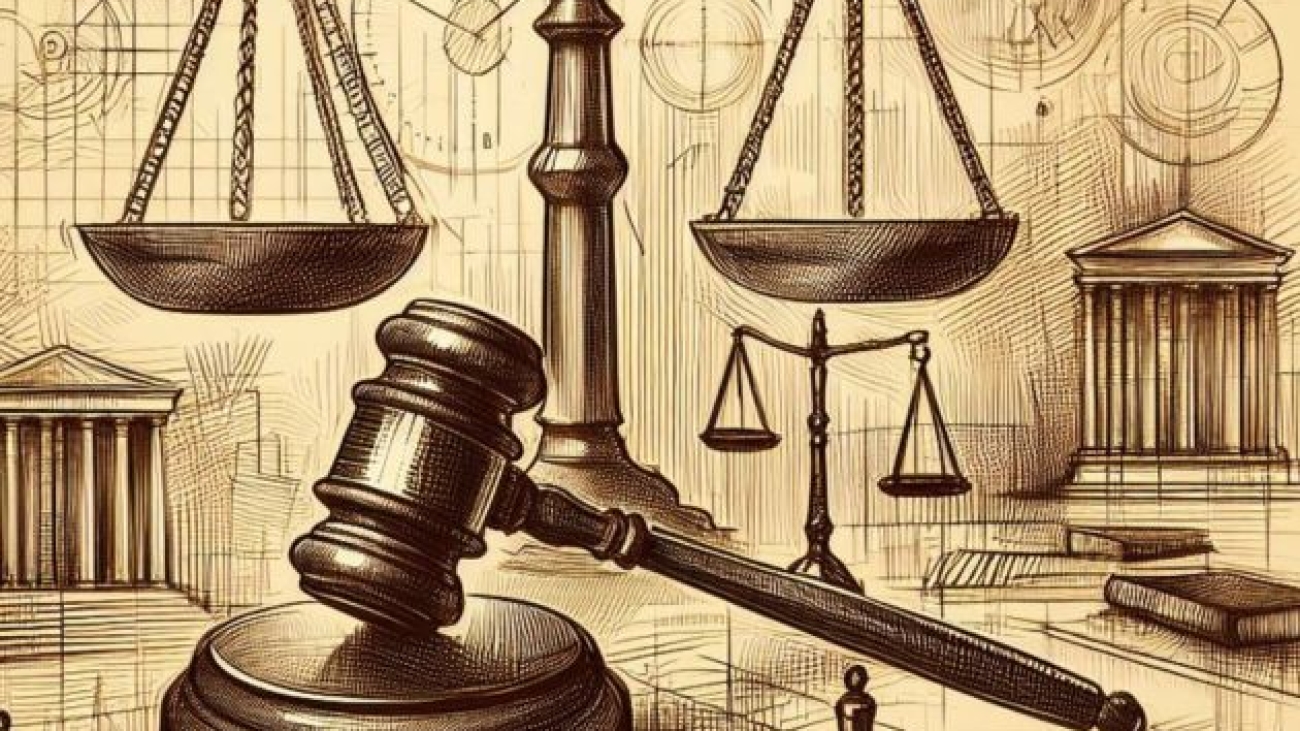

Finally in the Dock

Today’s drama in SCP between CJP and AG was more of a press conference than court proceedings. Only one judge among these seven could possibly write a dissenting note, and that will be none other than our worthy stooge, the CJP.

From a Government Commission to a Suo Moto to a seven-member Bench to Full Court is quite a journey in the span of two days.

The circumstances that are developing as a result of this Letter of Mar 25 could prove to be a non-starter for certain contemplated amendments for extending the term of office of CJP and others, etc.

The direction that this case could take in Full Court proceedings may bring the establishment, the government, and the judiciary to a round table. There is already a request filed for a three-member judicial commission to probe the matter. It does not suit the Establishment at all that a Commission of serving SCP judges should probe into the allegations of offenses committed in the past.

ALSO READ: Federal Government Announces 4-Day Eid ul Fitr 2024 Holiday – Official Notification Issued

This probe into allegations of accesses as mentioned in the IHC Judges’ letter could also lead to producing people concerned before the commission. Such exposure? No way. The Commission could also start probing into Forms 45 and 47 controversies and those behind, which is basically a national calamity. And that could prove catastrophic for both the Government and the Establishment.

It may not be possible to defy the orders to appear if issued by the Judicial Commission. Please appreciate that these six bright stars have literally pitched Judiciary against the Establishment. It is a fact, whether you like it or not.

There is a long list of accesses, and a lot has happened directly and indirectly under the auspices of the Establishment ever since mid-2021 till to date. Some of the major glaring events are:

ALSO READ: President Zardari Condemns Baseless Allegations Against Military Leadership in COAS Meeting

Extended governance beyond 90 days of caretakers in Punjab, KPK, and in the Center, Sind, and Balochistan; Flouting of SCP order to hold elections by May 14, 2023; May 09 events not being probed despite the request of the accused party.

That could be given due attention, and the Judicial Commission could look into it, which will open another Pandora’s box; Neutrality of the Caretakers could be another serious issue. Caretaker PM and CM being elected as independent Senators is highly questionable and shall point fingers towards the establishment.

This also invokes the principle, ‘clash of interest’; May 09 episode, which has not been probed despite repeated requests by the accused could figure in promptly; Recent Jail trials of political leaders will, in all probability, be brought up and contested strongly; Issues like the arrival of five SCP judges in their offices at midnight, the arrival of a prisoner van, and the arrival of CJ IHC at 10 PM in his office (now seemingly a belligerent Judge today), a deadline of 12 midnight seem like minor but obvious and serious issues; The conduct of Senate elections together with Forms 45/47 controversy are real hot topics.

Senate election of caretaker PM & CM and a few others as independents seem like a joke and a result of blatant maneuvering. It is not possible that the Judicial Commission if appointed could miss out on these controversies surrounding the elections; Last but not least, the recent jail trials of some political leaders together with the haste that these trials were conducted. Repeated arrests despite bail orders by courts will all have to be probed.

If the TORs of this Judicial Commission (if and when appointed) do not give it the liberty to look into the larger picture of interference and accesses, it will not do any good. We shall be back to where we were.

Legal brains like Barrister Aitzaz and a few others together with HC Bar Associations have already jumped into the case. It seems to me that this letter by six Justices on Mar 25 has put too much on establishment plate, which they may find hard to chew

.ALSO READ: PM Shehbaz Sharif Urges Enhanced Pakistan-France Cooperation in Trade and Investment

This letter was certainly not expected and it would prove to be the second rude shock after that popular street show across Pakistan and in the world capitals on that April Sunday following IK ouster in 2022. The ground reality is that while the electorate is already against the establishment, this letter has literally clipped their wings.

We all know that if it was not for the judiciary, the establishment would not have had this clout and its vast empire, where the joke is that “Pakistan was chalked out on DHA land”. It should be a very worrying moment for them because what establishment has on their side are the people who do not have any vote bank but were maneuvered in by the establishment. This weakness could turn the tables.

Political parties driven to wilderness are indicating at starting a people’s movement after Eid. With this in view, 29th April is the next date of hearing announced today may be a bit too far because if a movement builds up by that time, it will be an added pressure on SCP.

In case it boils down to a tripartite conference between, Judiciary, Government, and Establishment, it will not be restricted to interference in judicial matters only. It will involve a complete package, i.e., complete adherence to the provisions of the Constitution and the limits set by it.

The basic issue here is that if an Institution is working within the confines of the Constitution and the SCP being a custodian of the Constitution will have to look at the complete package and not just the issues faced by judicial officers. It would be a very bitter pill to swallow.

The law requires that those who have been involved in the harassment in the past should be brought to book as offenders, which will damage the establishment credentials further from its current low.

The Judicial Inquiry Commission will have to make appropriate suggestions to uphold the independence of Judiciary together with strict adherence to the Constitution. SCP will then have to act accordingly and pass necessary orders.

I think that tripartite arrangement (read bargain) will be that past misdeeds should not be probed. Consensus could develop that we need to move forward and follow the principle of the dichotomy of power as contained in the Constitution.

As for me, I feel that Establishment is in the dock after all. As for the Government, the least said is better. I see them destined to be orphans.

(The writer is a Former Chairman and Managing Director PIA, Former Federal Minister of industries and production)

Game in Final Round: Interesting days ahead!