When the famous psychologist Erik Erikson informally said “Everything before the ‘but’ is horseshit,” a century ago, no one really paid heed. Today, the word ‘but,’ suggests that what follows may be more aligned with the speaker’s true thoughts or intentions, potentially casting doubt on the preceding statements. Some spoken statements last week:

– The economy is growing, but structural reforms …

– Inflation will come down, but …

– Rupee is strengthening, but…

– The election dates have been announced, but …

… & so the uncertainty goes on, with the fact that the Pakistan economy is still very fragile.

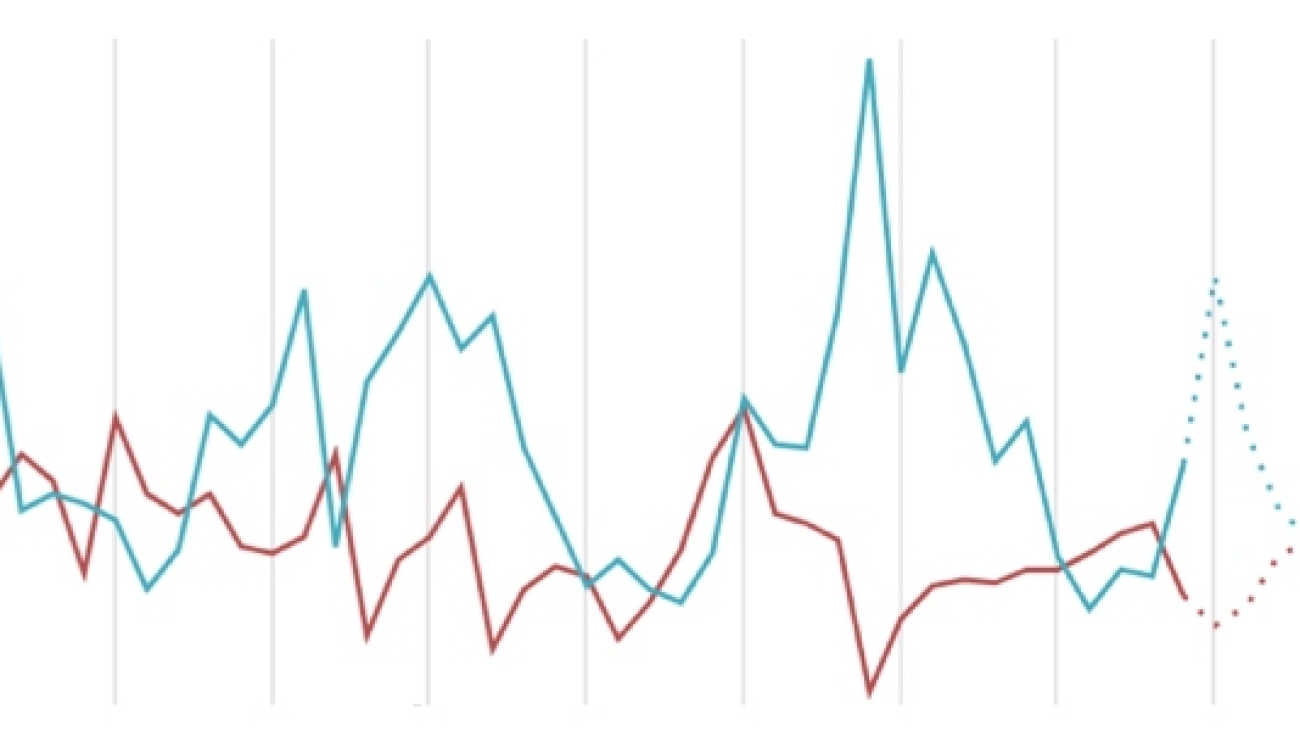

Interest rate outlook

One of the biggest uncertain segments is the interest rate. When CPI (Consumer Price Index) clocked in around 26% for Oct, the market went on a bond-buying spree predicting rates to come down. Subsequently, the increase in gas prices and the 2 consecutive SPI number of over 40% has cast solid doubts. Yields have consequently ticked up last week, and everyone is now looking for another round of data to project future inflation rates.

While most analysts don’t think of an increase in interest rates, they insist a no change will be akin to a hike, because the market has strongly factored in a cut. But a cut looks tricky if CPI comes above 30% (as is the market consensus), especially amidst a hawkish Fed and a unique interest rate trajectory in Turkey – in which they increased rates by another 5% yesterday to take it to 40%.

Rupee outlook

The rupee lost a few paisa in the last 2 trading sessions. The key triggers were declining reserves which deteriorated by $232mn & higher REER (Real Effective Exchange Rate), which weakened from 91.7 to 98. 6. However, most analysts think the lion’s share of the rupee weakness came as SBP (State Bank of Pakistan) bought swaps to prop forward premiums and subsequently started buying dollars from the market to boost reserves. In spite of profitable premiums, exporters were not active in selling forwards.

In the coming week, we see the Rupee to be range-bounded & vulnerable to news flows. Importers & exporters should just wait and see, which comes earlier – positive or negative news flows.

Fed determined to “Proceed Carefully”

The FOMC (Federal Open Market Committee) minutes were arguably slightly on the dovish side, with the committee now seemingly of the view that no further hikes will be needed, with the language instead focusing on the need to proceed carefully.

Yesterday, the PMIs (Purchasing Managers’ Index) came in stronger than expected in the UK and the eurozone but weaker in the US. Despite the notion that eurozone growth pessimism may have peaked, rate differentials still point to a weaker EUR/USD & EUR/GBP.

Read More: CM Mohsin Naqvi & UAE Ambassador discuss bilateral cooperation